Media Releases

The World Economy After COVID

Media Releases

Professor Sir David Greenaway examined the extent of economic impact from the pandemic and the relative capacity of the regions to rebound.

The COVID-19 pandemic has generated enormous uncertainty around the globe, and the world continues to wrestle with the economic risks and impact from the shocking pandemic. Professor Sir David Greenaway, Emeritus Professor of Economics at the University of Nottingham, reflected on aggregate short-term economic impact and speculated on possible consequences for the world economy, in a webinar organised by the Centre for International Trade and Business in Asia (CITBA) at James Cook University (JCU).

When the pandemic struck, there was a high degree of uncertainty about prospects for trade and growth. However, there is a growing consensus among forecasters on short-term responses.

For “Advanced Economies” such as the United States, United Kingdom, Singapore and Australia, there was a significant recession in 2020, but forecasts predict a robust recovery in 2021 that will be maintained in 2022. Similarly, emerging and developing countries such as Russia, Brazil and Mexico experienced a sharp recession in 2020, but are forecasted to have a pretty robust recovery in 2021. This indicates a “V-shaped” recession from the pandemic, as opposed to a “U-shaped” recession.

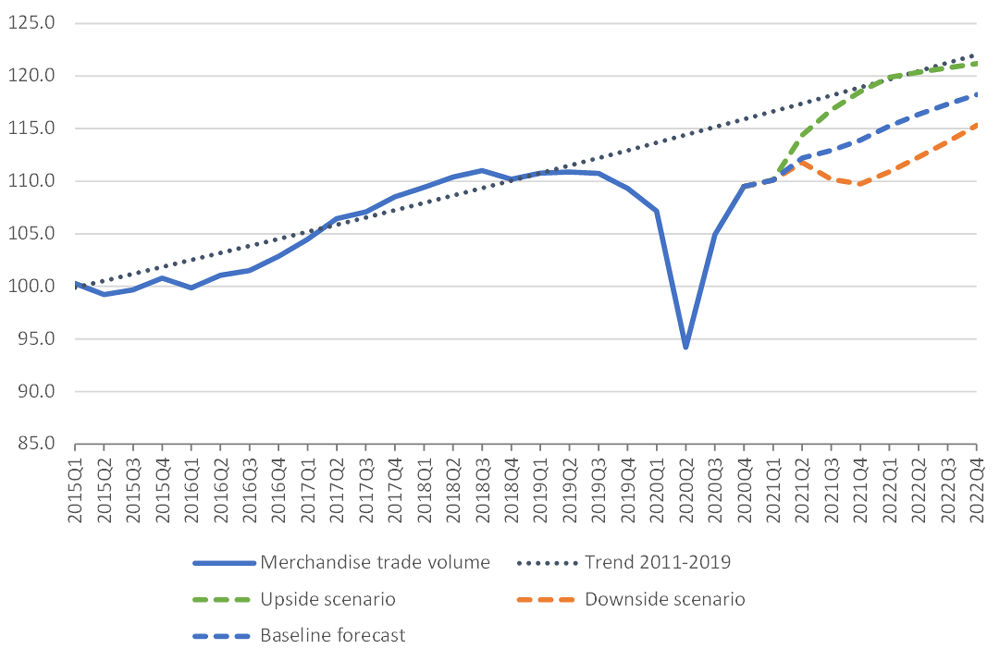

(Prospects for trade; Sources: WTO and UNCTAD for trade volume data; WTO for forecasts)

According to the World Trade Organization, there are two alternative forecasted scenarios for trade: In the upside scenario, vaccine production and dissemination would accelerate, allowing containment measures to be relaxed sooner. This would be expected to add about 1 percentage point to world GDP growth and about 2.5 percentage points to world merchandise trade volume growth in 2021. Trade would return to its pre-pandemic trend by the fourth quarter of 2021. In the downside scenario, vaccine production does not keep up with demand and/or new variants of the virus emerge against which vaccines are less effective. Such an outcome could shave 1 percentage point off of global GDP growth in 2021 and lower trade growth by nearly 2 percentage points.

While short-term prospects look encouraging, a number of downside risks—including debt overhang, inflation and financial tightening, trade tensions and conflicts, climate change–driven natural disasters, and further major shocks such as a pandemic resurgence, cyberattacks or financial crises—have given reasons for pessimism in the medium term.

At the same time, the acceleration of vaccine penetration and hard wiring of value chains provide optimism for the resilience of world trade. The advancement of technology, artificial intelligence and innovation can also play critical roles in shaping the world and facilitating value chains.

COVID-19 is a once-in-a-century shock and triggered the deepest recession since World War 2, and a sharp contraction in trade, provoking an extraordinary scale of policy interventions. We are likely to see a strong recovery in GDP growth in 2021 (+6%) and trade (+8%).

Ultimately, short-term prospects for the world economy depend upon vaccine rollout and the evolution of the pandemic; inflation, financial tightening, and debt servicing; as well as trade tensions and conflict. Meanwhile, medium-term prospects for the world economy depend upon the targeting, timing and sequencing of policy interventions; trade tensions and conflicts; inequality, uneven growth and social unrest; climate change–driven natural disasters; and the unknown trajectory of technology.

View the full recording of the webinar “The World Economy After COVID”.

Find out more about the Centre for International Trade and Business in Asia (CITBA).

Discover further information on areas of research and research strength at James Cook University in Singapore.

Contacts

Media: Pinky Sibal [email protected]